All Categories

Featured

Table of Contents

If George is diagnosed with a terminal illness during the initial plan term, he probably will not be qualified to renew the plan when it ends. Some plans provide guaranteed re-insurability (without proof of insurability), but such attributes come at a greater price. There are several sorts of term life insurance policy.

Most term life insurance policy has a degree costs, and it's the kind we've been referring to in many of this short article.

Term life insurance policy is attractive to youngsters with kids. Parents can obtain substantial protection for an inexpensive, and if the insured passes away while the policy is in result, the family can depend on the survivor benefit to replace lost revenue. These plans are likewise appropriate for people with expanding family members.

What is Term Life Insurance With Level Premiums? How It Helps You Plan?

Term life policies are ideal for people that want considerable protection at a reduced expense. Individuals that possess entire life insurance pay extra in costs for less coverage but have the security of understanding they are safeguarded for life.

The conversion rider should allow you to transform to any kind of long-term plan the insurer provides without limitations. The key functions of the motorcyclist are keeping the original health score of the term policy upon conversion (also if you later on have wellness concerns or end up being uninsurable) and choosing when and exactly how much of the protection to convert.

Of course, overall costs will boost dramatically because entire life insurance coverage is more pricey than term life insurance policy. Clinical conditions that develop during the term life duration can not create costs to be boosted.

What You Should Know About Voluntary Term Life Insurance

Whole life insurance policy comes with substantially greater monthly costs. It is suggested to provide insurance coverage for as lengthy as you live.

It depends on their age. Insurer set a maximum age restriction for term life insurance policy plans. This is typically 80 to 90 years old but may be higher or lower depending upon the company. The costs additionally rises with age, so a person matured 60 or 70 will pay substantially more than someone decades more youthful.

Term life is somewhat comparable to vehicle insurance coverage. It's statistically unlikely that you'll require it, and the premiums are money down the tubes if you don't. However if the worst takes place, your household will obtain the benefits (Level term life insurance meaning).

What is Term Life Insurance Coverage Like?

Generally, there are 2 sorts of life insurance policy plans - either term or permanent strategies or some mix of the 2. Life insurance firms supply different types of term strategies and traditional life plans along with "rate of interest sensitive" items which have actually become more common considering that the 1980's.

Term insurance policy supplies defense for a specific time period. This duration can be as brief as one year or provide insurance coverage for a particular number of years such as 5, 10, two decades or to a defined age such as 80 or in many cases as much as the oldest age in the life insurance policy mortality tables.

What is Term Life Insurance For Couples? What You Need to Know?

Currently term insurance prices are really competitive and among the cheapest traditionally experienced. It ought to be kept in mind that it is an extensively held idea that term insurance policy is the least expensive pure life insurance policy protection readily available. One needs to evaluate the policy terms carefully to choose which term life alternatives are appropriate to satisfy your particular situations.

With each brand-new term the premium is increased. The right to restore the plan without evidence of insurability is a vital advantage to you. Or else, the threat you take is that your health and wellness might weaken and you may be not able to get a policy at the same prices or also at all, leaving you and your beneficiaries without insurance coverage.

The size of the conversion duration will differ depending on the kind of term policy bought. The premium price you pay on conversion is generally based on your "existing attained age", which is your age on the conversion day.

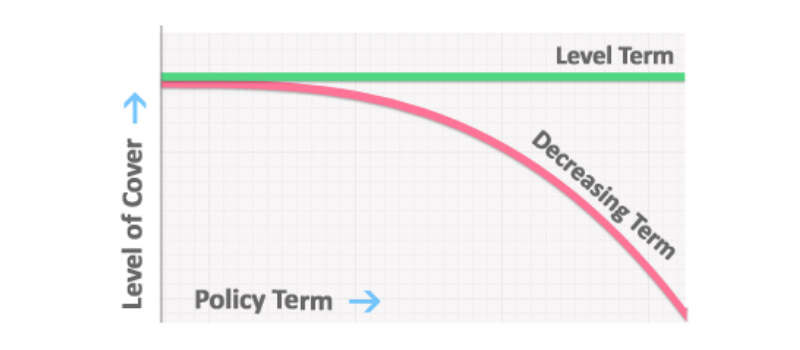

Under a degree term policy the face quantity of the plan continues to be the exact same for the entire period. With lowering term the face quantity minimizes over the duration. The premium remains the exact same each year. Often such plans are sold as home loan defense with the quantity of insurance decreasing as the balance of the mortgage lowers.

Generally, insurance companies have not had the right to change costs after the policy is marketed. Considering that such policies may proceed for several years, insurance companies must utilize traditional mortality, rate of interest and expense price estimates in the premium computation. Flexible costs insurance coverage, however, enables insurance firms to supply insurance at lower "current" costs based upon much less conservative assumptions with the right to alter these premiums in the future.

What Makes Joint Term Life Insurance Different?

While term insurance policy is made to provide defense for a specified time period, permanent insurance coverage is designed to offer coverage for your whole life time. To keep the costs rate degree, the premium at the more youthful ages surpasses the real price of security. This extra premium constructs a get (cash worth) which helps pay for the policy in later years as the expense of protection surges above the premium.

Under some plans, costs are called for to be paid for a set number of years (Joint term life insurance). Under various other policies, costs are paid throughout the insurance policy holder's life time. The insurance policy business spends the excess costs dollars This kind of plan, which is in some cases called cash money value life insurance policy, creates a cost savings element. Cash worths are vital to a long-term life insurance policy policy.

Occasionally, there is no relationship between the dimension of the money worth and the premiums paid. It is the cash money value of the policy that can be accessed while the insurance holder is to life. The Commissioners 1980 Criterion Ordinary Mortality (CSO) is the current table used in calculating minimum nonforfeiture values and plan reserves for regular life insurance policies.

What Exactly Is Direct Term Life Insurance Meaning Coverage?

Lots of permanent policies will have arrangements, which define these tax obligation needs. Conventional entire life plans are based upon long-term price quotes of cost, interest and mortality.

Latest Posts

Best Funeral Expense Insurance

Burial Insurance Seniors

Life Insurance And Funeral Plan